How can foreigners buy property in Australia?

You may be wondering; how can foreigners buy property in Australia? Well, good news! Foreigners living in Australia or living abroad can buy property in Australia.

Also, many residents who hold temporary visas (TR) or permanent visas (PR) may be missing out on the benefits of the Australian real estate market because they do not know they may qualify for a home loan.

Australia is one of the best countries in the world to live in when based on global comparisons of health, education, income and quality of life. It is for these reasons and others, that Australia is one of the popular immigration destinations.

In light of the current COVID-19 pandemic, Australia’s immigration intake is set to change. Our views on Australia’s immigration policy after the pandemic were expressed in a previous blog – What will Australia’s Immigration look like after the pandemic?

Owning your own home is known as living the Australian dream. When you move to Australia, it is also likely that you may want to own your own home too.

Australian homes are comfortable, safe, secure and in most cases are also a good investment. So, how can foreigners buy property in Australia? Well, the requirements vary depending on whether you are a non-resident, temporary resident or a permanent resident.

To buy a property in Australia as a foreigner, there are some conditions that need to be met. For example, temporary residents, foreign residents and short-term visa holders from any country will need to apply to the Foreign Investment Review Board (FIRB) to buy property in Australia.

Let me walk you through it…

Non-residents

Who are permanent non-residents?

Non-residents are individuals who do not ordinarily live in Australia but hold visas that allow them to remain in Australia for a limited period.

Established dwellings

– Non-residents cannot purchase established dwellings.

– Non-residents can purchase vacant land for residential dwelling development subject to some conditions.

New dwellings

– Non-residents, can buy new dwellings without being subject to any conditions. The FIRB usually needs to give approval prior to each acquisition.

Temporary residents

Who are temporary residents?

Temporary residents are individuals who hold a temporary visa (TR) that permits them to remain in Australia for a continuous period of more than 12 months or have applied for a permanent visa (PR) and hold a bridging visa.

Established dwellings

– Temporary residents cannot buy established dwellings as investment properties.

– As Temporary resident, you can only purchase one established dwelling which must also be your primary place of residence. You are not allowed to rent any part of the property.

– As Temporary resident, you are allowed to buy an established home for redevelopment with some conditions.

New dwellings

– As long as the FIRB approves each acquisition, you can buy as many new homes as you desire. The property must not have been earlier sold as a dwelling, nor have been constructed to replace one or more demolished established dwellings, nor have been occupied before.

– Temporary residents may also purchase vacant land for residential housing development subject to some conditions.

Permanent residents

Who are permanent residents?

Permanent residents (PR) are individuals who have been granted a visa to live and work in Australia indefinitely. Please note, someone who holds a permanent visa does not mean they are a citizen.

Great news! There are no FIRB restrictions for permanent residents (PR holders). Australian permanent residents share the same treatment as citizens with regards to the purchase of residential property in Australia.

For further details please see Real Estate

Can foreigners borrow money in Australia?

Yes, foreigners can apply for a loan to buy property in Australia. While other countries have very complicated foreign investment laws or banking regulations that make it difficult to invest or borrow money, Australia does not. Down under in Australia remains an attractive destination for foreign investment.

Some banks have tightened lending rules to foreign investors as well as temporary residents of Australia and in some cases for Australians living overseas. Financial institutions have various rules on the amount you can borrow depending on your visa type and situation.

Like visa policy, policy relating to lending options for foreigners can change at anytime without notice.

Do you need a mortgage broker?

A mortgage broker is an individual who acts as a intermediary between a lending institution and a borrower. Sometimes a specialist mortgage broker can assist you in qualifying for a foreign mortgage.

Not only will you save time and avoid complexity, but you will have a more chance of getting a lower interest rate. A mortgage broker helps borrowers connect with many lenders by seeking out the best loan for you and your circumstances.

Whilst they may not be common in some countries, mortgage brokers are popular in developed mortgage markets like Canada, the United States, the United Kingdom, Australia, New Zealand and Spain.

Real estate markets and the financial system work differently in each country, we strongly suggest that for Australia you seek advice from a mortgage broker.

What is the most affordable city in Australia?

Depending on whether you are seeking an inner-city apartment or something more off the beaten track, property prices in Australia range widely depending on where you live.

Because it is a popular country to live in and there is a housing shortage, Australia is undergoing a boom in property prices. For this reason, Australian property prices are high by world standards.

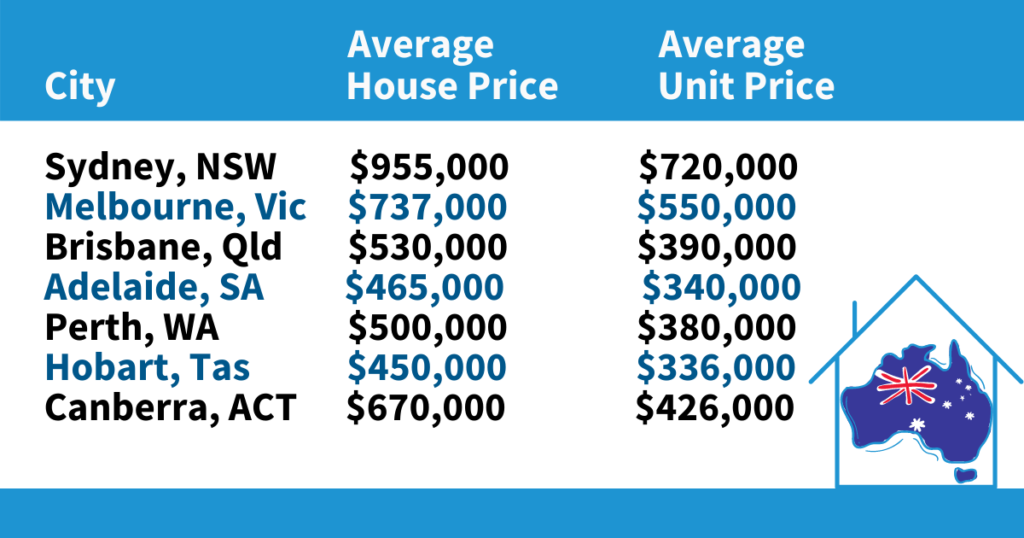

Hobart remains the cheapest city in Australia in which to purchase a home while Sydney, Melbourne and Canberra are the most expensive.

Average house prices around Australia

foreigners buy property in Australia What deposit amount do I need to buy property in Australia?

Having a target price in mind will drive you and keep you on track when it comes to buying your first property.

The typical deposit amount required to secure a home loan in Australia is around 20% of the property value although it is possible to buy a property with a low deposit amount.

The minimum deposit can be as low as 5% of the property’s price but this may be subject to a higher interest rate and also require mortgage insurance (see below).

Other costs:

– Lender’s Mortgage Insurance (LMI): is a type of insurance policy which covers the mortgage lender against potential losses if you borrow more than 80% and are unable to repay the loan.

Migrants can also be required to have a larger deposit than usual, due to difficulties in securing mortgage insurance (often required when borrowing more than 80% of the property value).

I know that’s a lot to take in, but bear with me…

– Stamp duty: this is the amount of tax you will pay for each property purchase. The amount of tax varies between states and territories but can be up to 10% of the property value. In most cases stamp duty can also be financed.

– Legal costs: in Australia, it is common for a solicitor or conveyancer to review the contract of sale and mortgage documents to ensure that there are no unfair terms or penalties which may cost you in the future.

What is the current interest rate in Australia?

Interest rates in Australia might be the lowest they will ever be! Yes, property prices in Australia may sound a bit high. However, current interest rates in Australia are among the lowest in the world. Because a home loan is a long-term commitment, even a small reduction in interest adds up over time.

Right now, the typical interest rate to buy property in Australia is between 3 to 4% but you can find variable rates as low as 2.17% depending on your particular circumstances.

Can I get a Permanent Residency if I buy property in Australia?

No, you cannot get Permanent Residency (PR) if you only purchase property in Australia.

However, if you are applying for an Australia visa, using the points-based system, in some states you may earn additional points if you purchase a residential or commercial property. In this case, you must hold the Certificate of Title or have rates notice to prove ownership.

If you are a real estate investor buying, selling or managing properties in Australia, you may wish to consider applying for Business Innovation and Investment (188 Visa) which is another pathway to Australian Permanent Residency.

Moving to a new country such as Australia can be a challenge. You may have heard mixed experiences.

I believe that Australia is a land of great opportunity and for this reason, many people from all over the world now call Australia home. If you are interested in relocation tips, please our previous blog 11 tips you want to know before you move.

About Rocket Remit

Rocket Remit is the worlds fastest international money transfer service. Send money instantly to over 38 overseas countries at very competitive rates.

Use the country selector to choose the country and check the rate.

Click here for more information on how to send money using Rocket Remit.