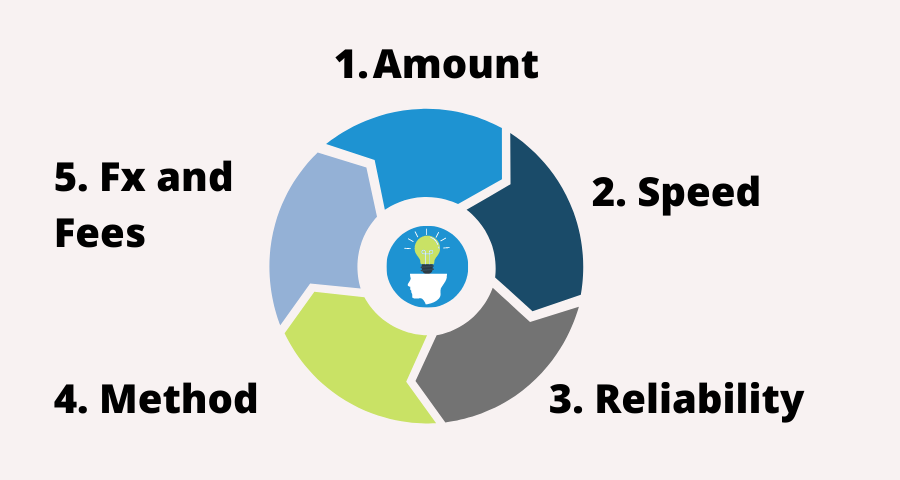

5 Factors to consider before sending money to India

There are many ways to send money to India from Australia. You can use a bank transfer, a wire transfer, an international money order, or an international bank draft. This article will show you factors to consider before sending money to India.

Many Australians are looking to send money internationally and often wonder which country is the best option. The answer to this question is not as simple as it may seem. We will explore some considerations you should consider before deciding the best way to send money internationally.

Australia has several different options for sending money overseas, each with pros and cons. We will also explore, some of the different ways to send money to India, including bank transfers and wire transfers.

1. How much money are you transferring?

The total amount you wish to send may influence the optimum sending method. Traditionally, money transfer to India has been expensive, so it’s common to save a year’s remittance and send it all in one go. That way, you would pay a lower fee as you sent only once.

However, with new mobile technology, sending money to India is almost free with some remittance providers, so there’s no need to hold on to your money for a year and send it all in one go.

There is also an economic argument to send a smaller amount frequently.

Let me explain…

If you are familiar with the “time value of money” principle, you will agree with me that it is better to send the money in the present moment to India than keep it in your savings account. “$100.00 today is worth more than $100.00 tomorrow”.

If you are unfamiliar with this phrase, let me clarify it.

As the value of money changes over time, it is the concept that cash available at the present moment compounds in weight and is therefore worth more than the same amount in the future.

Consequently, the funds will have a better impact on the recipient if sent in the current moment, rather than accumulating funds for one (1) more significant transaction in the future.

Providing that transaction costs are free, it is more valuable to your recipient to receive multiple transfers to India in regular, more diminutive amounts.

For example, if you have $100.00 today, with a nominal interest rate of 2%, it may be worth $102.00 a year later. A year later, your $100.00 has turned into $104.04.

2. How fast do you need the money in India?

One thing you will need to consider when choosing a method for sending money overseas is how quickly you need your funds to arrive at their destination.

The timing of the fund’s transfer can be a significant factor when sending money to India. Some transfers take days to finalise, whilst others are completed almost instantly. Keep in mind that if your transfer is instant, your recipient does not have to wait hours or days for the funds.

Using instant money transfer, you know your recipient has received your money straight away! No more checking or following the “status” of a transfer! Plus, you also have peace of mind that the funds have not been lost which can be stressful! For this reason, the quicker the transfer, the better!

Another way to think of it is that the larger the transfer, the longer the transaction takes to complete.

Depending on your provider, if you send less than 1,000.00 AUD, your recipient in India will typically receive the funds immediately. For amounts more significant than 1,000.00 AUD, it is likely to take between 1 to 3 business days.

3. Reliability of the company

If you need a trusted and reliable remittance company that can help transfer money to India, then several providers offer excellent services. You might want to read the reviews of these trusted companies before selecting a service provider.

Today, the world is a global village today with people travelling across the globe. India has also become an important market for many businesses from other countries. Sending money to India through a remittance company becomes necessary when you have family and friends living in India.

Registered with AUSTRAC

Before you make the final decision, check that the company is reliable and trustworthy. There are many scams out there that try to steal money from people who need it the most.

All remittance service providers in Australia must be registered with AUSTRAC and comply with all Australian regulations.

Unregistered providers could be supporting illegal activities and could be used for money laundering or other criminal activities. They could be used to send money to places where it could be used for terrorist activities.

4. Sending and receiving method

You will want to make it as easy as possible for your recipient to receive your remittance. One option is to use a method where they do not need to travel to access money, such as electronic or digital remittance.

While cash pickup is still a popular option, avoiding large sums of cash is preferred for safety and practical reasons. Non-cash remittance options also mean the recipient does not need to travel to make payments from the funds received.

Send money to bank accounts in India

You can send money directly to a bank account in India in seconds . About 80 percent of Indians above 15 years of age own an account at a bank or an other financial institution.

You will need to know the beneficiary’s bank details, including their name, address, bank name, account number and the Indian Financial System Code (or IFSC code).

What is an IFSC code?

The Indian Financial System Code (or IFSC code) is an 11-digit alpha-numeric code assigned by the Reserve Bank of India to uniquely identify every bank branch participating in the payment system.

This number helps identify the account to transfer the money. It is essential in international transactions to bank accounts from Australia to India.

PayTM

Some people are confused between having PayTM account and having an account with PayTM Payments Bank. To receive international remittance, make sure your beneficiary has an account with PayTM Payments Bank. A regular PayTM account is used for small, simple, domestic transfers within India only and does not require full ID verification. It cannot receive international funds.

To receive funds internationally, your beneficiary will need to create a separate account with PayTM Payments Bank which will require full ID verification. See How to Transfer Money Instantly to PayTM Payments Bank India

5. Cost of a remittance transaction

If you are away from your loved ones, you may want to send cash as a gift or for a special occasion such as a wedding or anniversary. Or, you may want to help family and friends with medical or education fees or assist them with general expenses. If you have a property in India and need to make mortgage payments, you may also need to make regular transfers.

Finally, you may simply want to make voluntary donations to charities or organisations or to assist people in India improve their circumstances.

The price for a remittance transaction usually includes a transaction fee charged by the sending agent, typically paid by the sender in Australia, and a currency-conversion fee for delivery of local currency. Sometimes these are itemised but mostly they are reflected in the AUD/INR rate for the transfer.

The easiest way to send money to India is through the Rocket Remit website. You can do this by clicking on the “Send Money” tab and then entering your recipient’s details. You will need their name, bank account number, and the bank name.

The fastest and most competitive money transfer to India

Rocket Remit is the worlds fastest international money transfer service. Send money instantly to over 45 overseas countries at very competitive rates. Use the country selector to choose the country. Click here for more information on how to send money using Rocket Remit.

Rocket Remit send your money anywhere across India. Transfer easily to bank accounts at ICICI, SBI, HDFC, Kotak, Axis Bank and many more! We transfer money to all popular banks in India.