How to make 2023 your best financial year!

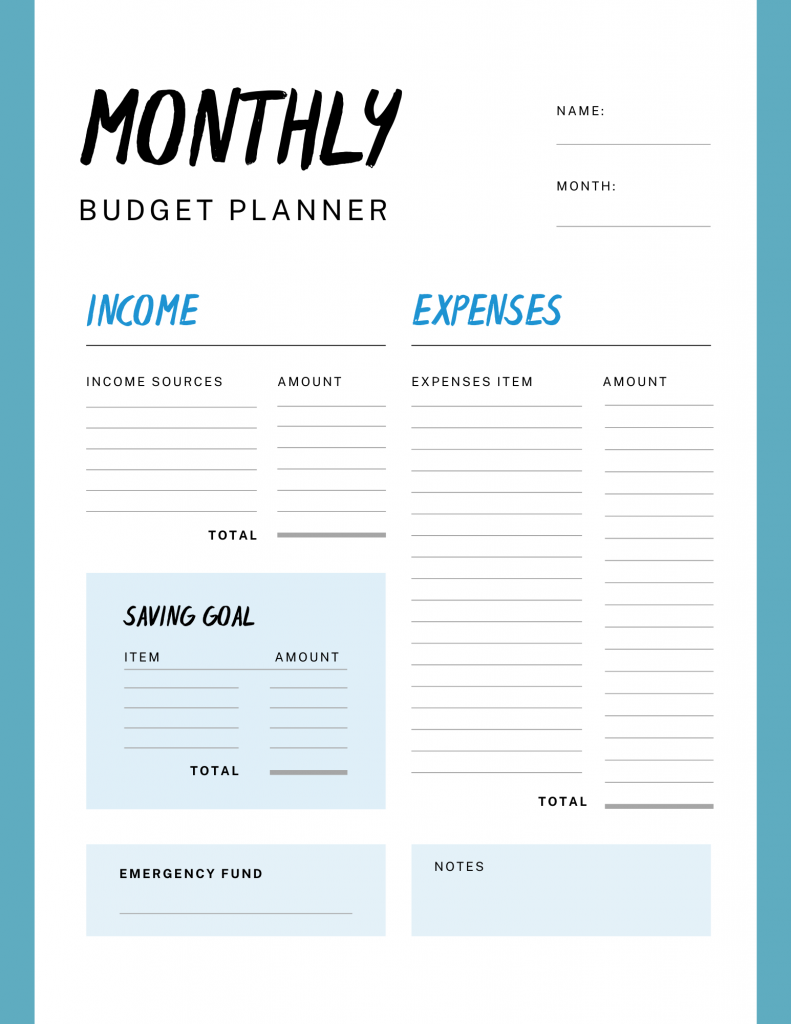

Planning your finances is the first important step to making 2023 your best financial year. You need to know what you can afford and how much money you have coming in and going out of your account. Budgeting, saving, and investing are all great ways to ensure you are financially secure for the future.

Why you need a budget

A budget is one of the best ways to manage your money, but only some have a budget. Pick budgeting principles that make sense for you. If you feel restricted by your budget, you’re probably budgeting incorrectly.

It seems like it takes a lot of work to develop an idea for your first budget, and it might be overwhelming initially. But creating your plan is worth the effort to take control of your finances and maintain peace of mind.

5 steps to a budget made easy

1. Set realistic goals

2. Gather your financial statements and identify your income and expenses

3. Create a list of monthly expenses and separate needs and wants

4. Design your budget within your income

5. Review your budget periodically

Set realistic goals

Being optimistic and positive is great, but when it comes to budgeting, being realistic is a better approach.

You can work on a 5 or 10 year plan for those ideas that seem far away, but for now let’s talk about the annual budget. So for now we will focus on goals that are realistic to your current income.

Some common financial goals of people who start life in another country are:

– Buying a car in Australia

– Buying a house in their home country

– Getting a loan to buy property in Australia

– Going to university in Australia

– Paying for family holidays

– Paying for family members’ education

– Starting a business in Australia

– Travelling to visit family back home

Australian homes are comfortable, safe, secure and in most cases are also a good investment. So how can foreigners buy property in Australia? Well, the requirements vary depending on whether you are a non-resident, temporary resident or permanent resident. For more information check our blog How can foreigners buy property in Australia?

Identify your income and expenses

There’s no better time than the dawn of a New Year to sit down and take stock of exactly how much has been leaving your account every month. The trick with working out your spending is to be as forensic and honest as possible This is definitely not something to casually do while relaxing on the couch with just a pen and pad of paper to hand.

If you are employed, your main source of income is probably your salary. Additional income like business profits, interest, dividends, rental income, capital gains or side hustle are also part of your total income.

Rather than trying to estimate your income and expenses, you’ll want to use as much hard data as possible. A good online banking app can come in very useful, as it should let you look back and chart exactly how much you tend to spend on different categories.

Categorise spending

– Clothing

– Debt repayments

– Entertainment expenses

– Education

– Groceries

– Healthcare (insurance)

– Home, car and other insurance policies

– Home utility bills

– Phone and internet bills

– Petrol/car and/or public transport

Separate needs and wants

Something important when organising a personal budget is to identify the things that you need. In other words, those things that you cannot stop paying or buying because they are necessary. For example rent may be an example of something you need.

The things you want are those things you don’t actually need. You could go on without them, but you want them because you feel you deserve them. For example do you absolutely need to upgrade your mobile phone as soon as a new model is released?

It does sound a bit restrictive to put all your expenses in two categories right? But only in this way can you consciously make decisions when you have to pay for something. Always ask yourself – do I need it or do I want it?

Design your budget to fit within your income

Allocating a percentage of your income to your different expenses is a way of making a budget. However, sometimes this is not always realistic for the needs of each individual.

Follow something that is easy for you to check and update. If it’s too complicated, chances are you will loose interest and not follow it. For example you can use a simple spreadsheet or an online budgeting tool to design your budget.

Financial apps are a great way to improve your personal finances and reach your financial goals. Regardless of what stage of life you are at or your personal financial goals, you could benefit from these apps. Best Finance Apps for Immigrants in Australia

Review your budget periodically

Reviewing your budget periodically is the key to making it work. You should check in every month or even weekly and make sure that the numbers are still on track with what you planned.

This will help you keep track of your spending and make sure that you always have money left for the things that are important to you. It’s important to review your budget periodically because your expenses might change over time – as well as your income!

Invest in yourself and keep learning

What does it mean to invest in yourself? Investing in yourself will help ensure that you are constantly growing and improving personally which will lead to more opportunities for success in other areas of life, like personal finance.

Investing in yourself is one of the most important things you can do to make 2023 your best financial year. It doesn’t matter if it’s a new skill or taking a class at night. You have to be willing to invest in yourself and always keep learning.

The world is changing rapidly and the only way to keep up with it is by investing in our knowledge. Don’t be afraid to explore or to try something new.

For example, don’t think of maths course as wasted hours if you’re not a maths person. You will still learn something about mathematics that you may not have otherwise.

About Rocket Remit

Rocket Remit is the worlds fastest international money transfer service. Send money instantly to over 45 overseas countries at very competitive rates.

Use the country selector to choose the country and check the rate.

Click here for more information on how to send money using Rocket Remit.