Hidden fees in the remittance industry

Millions of people send money across borders yearly, fuelling economies and supporting families. This process, known as remittance, plays a considerable role globally. But, there’s a catch – hidden fees. Imagine sending $100 for your family to receive less than you expected. Why? Because of costs, you didn’t see coming. That’s where the need for clear, upfront pricing comes in. We’re exploring the world of remittances to uncover the truth about these hidden fees and why simple, clear, open prices are so important. Let’s get started on this journey so we make every cent count!

Understanding remittance fees

As we explore sending money internationally, it’s essential to understand the various fees involved, which can significantly impact the total cost. Comparing remittance fees is a very confusing process. Some remittance businesses make it very difficult to understand their fees which makes it even more difficult to accurately compare fees.

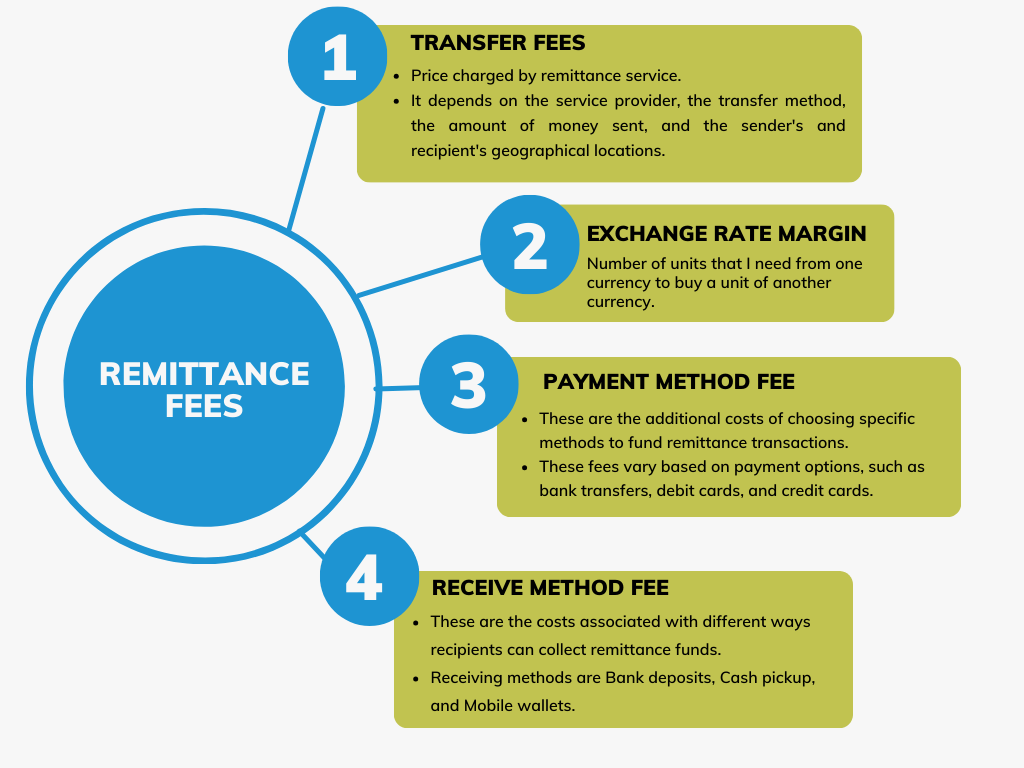

Here’s a breakdown of remittance fees:

Transfer fees: These are the upfront charges applied when you initiate a money transfer. They can be a fixed amount or a percentage of the transfer amount, directly affecting the cost of sending money. Just because a transfer fee may be small or even zero, does not mean there is a hidden fee somewhere else.

Exchange rate margins: The exchange rate is how much your money is worth in another currency. Beyond the nominal exchange rate, many services add a bigger margin (extra profit), charging more than the market rate for currency conversion. This hidden cost can substantially reduce the amount the recipient gets. For more information on exchange rates, read our blog Everything you need to know about exchange rates.

Payment method fees: The choice of payment method, such as a bank transfer or credit card payment, can also incur additional fees. Each method has its cost structure, influencing the overall expense of the transaction. As a rule your bank may charge extra fees if you use your credit card to make a payment as remittance can be counted as a “cash advance”.

Receiving method fees: The way recipients receive money can attract different fees. Cash pickup may be more expensive than direct bank deposits, affecting the total obtained amount. Some receiving banks also charge a processing fee.

Understanding these fees is crucial for anyone looking to send money abroad efficiently and cost-effectively. With this knowledge, you can make informed decisions, ensuring you select the most suitable and economical remittance service.

When comparing remittance services, be aware of hidden fees

When choosing the service for sending money abroad, comparing your options is essential. Not all services are created equal, and the best choice for you might not be the best for someone else. Here’s how to make sure you’re getting a good deal:

Look at the fees: Start by comparing the transfer and exchange rate fees across different services. Some offer low transfer fees but make up for it with high exchange rate margins. Finding a balance is crucial.

Check the speed: How fast does your money need to get there? Some services offer same-day transfers, while others might take a few days. If speed is important and the amount is relatively small, consider mobile money transfers as this method is immediate and at lower cost.

Consider convenience: How easy is it to send money? Can you do it from your phone or visit a physical location? Also, think about the receiving end. Choose a service that makes it easy for your loved ones to get the money.

Read reviews: What do other people say about the service? Look for reviews online to see if others have had a good experience with customer service, reliability, and overall satisfaction.

Security matters: Ensure your chosen service is reputable and has robust security measures to protect your money and personal information.

By comparing different remittance services based on these criteria, you can find a solution that offers the best cost, speed, convenience, and security. Making an informed decision helps ensure that more of your hard-earned money makes it to its intended destination safely and affordably. Let’s move forward to understand how to spot and avoid hidden fees, making your remittance experience smoother.

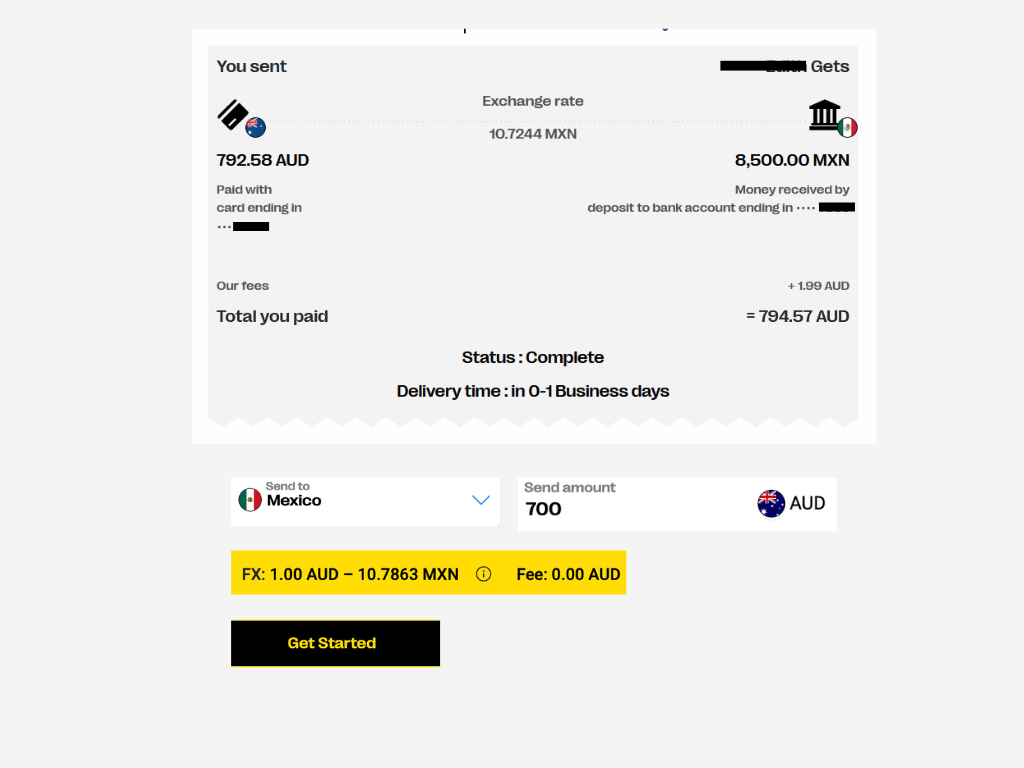

Rocket Remit promises transparency and simplicity in remittances. When we quote a fee for your transaction, it covers all the costs in the remittance process. There are no hidden charges, no last-minute surprises – just the peace of mind of knowing exactly what you’re paying upfront.

How to spot and avoid hidden fees in remittance

Spotting and avoiding hidden fees ensures you get the most out of your remittance transactions. The first thing to do is ask for the total cost upfront, which includes all fees and the exchange rate. This clarity is crucial as it helps avoid surprises later, ensuring you know exactly how much money will reach your intended recipient.

When considering the exchange rate, it’s crucial to understand that while rates fluctuate, some services add a significant margin without transparent disclosure. You can spot added margins by comparing the service’s rate to the current market rate. This comparison is essential for identifying services that offer fair rates versus those looking to profit from your lack of information.

Moreover, looking for additional fees that could be applied to your transaction is necessary. This includes fees for using specific payment methods like credit cards or fees incurred when the recipient collects the cash. A deeper understanding of these fees is essential, primarily related to loading money through various methods like debit cards, bank transfers, credit cards, and other forms. In addition, it’s crucial to be wary of remittance companies that advertise “zero fee” transactions, as the reality might be different once you’re ready to send.

The appeal of “zero fee” promotions by some remittance companies can be particularly misleading. These advertisements draw in customers with the promise of cost-free transactions, but unexpected fees might emerge as you proceed to the final steps of sending money. These could be in the form of exchange rate markups or processing fees that were not disclosed upfront.

Regulatory environment for remittance

Consumer rights in the remittance process are a critical aspect of these regulations. In Australia, the regulatory framework for remittances is designed to protect consumers and ensure the integrity of financial transactions.

The Australian Transaction Reports and Analysis Centre (AUSTRAC) oversees remittance service providers, enforcing regulations that demand transparency and accountability. The Australian Securities and Investments Commission (ASIC) also plays a crucial role in consumer protection within this sector.

Australian regulations mandate that remittance providers offer precise information about transaction fees, exchange rates, and the total amount the recipient will receive before the transaction is finalised. This level of transparency empowers consumers to make informed decisions and facilitates comparison shopping among different services. Also, consumers have the right to receive a detailed receipt for each transaction, which includes all relevant financial details, enhancing the traceability and accountability of the remittance process.

Wrapping up the exploration of hidden fees in remittance

Understanding the landscape is key to navigating it successfully. From examining various fees to choosing the right service and ensuring digital security, every step is crucial to ensuring your money reaches its destination efficiently and affordably.

It is important to be vigilant against hidden fees, especially when loading money through debit cards, bank transfers, and credit cards. Many “zero fee” promotions have been exposed as misleading, revealing the importance of reading the fine print and asking for complete fee disclosures upfront.

Choosing a remittance service is about more than just finding the lowest fees or the fastest transfer time. It’s about transparency, security, and understanding your rights as a consumer. Regulations in Australia are a testament to the global effort to make remittance services more user-friendly and less fraught with unexpected costs.

About Rocket Remit

Rocket Remit is the world’s fastest international money transfer service. Send money instantly to over 50 overseas countries at very competitive rates.

Use the country selector to choose the country and check the rate.

Click here for more information on how to send money using Rocket Remit.

Download the Rocket Remit app from Google Play or the Apple Store